Business asset depreciation calculator

The decision to use Section 179 must be made in the year the asset is put to use for business. The amount of value an asset will lose in a particular period of time.

Sum Of Years Depreciation Calculator Double Entry Bookkeeping

The straight line calculation as the name suggests is a straight line drop in asset value.

. Enter the purchase price of a business asset the likely sales price and how long you will use the asset to compute the annual rate of. PENTAGON 2000SQL ERP Systems for the Aerospace Defense Electronics and More. Web Depreciation Amount Fixed Depreciation Amount x Number of Depreciation Days 360.

Proven Asset Management Resources. Ad Fixed Asset Pro Is Continually Updated For The Latest Changes In Tax Depreciation Rules. Web Track assets and calculate your clients depreciation automatically.

A fixed asset has an. Web 121000 x 0019 2299. Find the assets book value by.

Ad How To Value Your Small Business and Small Business Assets Selling A Business or Assets. Web Depreciation Amount Fixed Depreciation Amount x Number of Depreciation Days 360. Web The calculator will display how the asset will depreciate over time the depreciable asset value the yearly depreciation rate and the annual depreciation.

This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers. A fixed asset has an. Setup needs to be done to calculate additional depreciation for Fixed Assets.

Ad PENTAGON 2000SQL ERP Systems Provides Fully Integrated Environment for Business. Small Business Valuation Is Your Business Worth Selling Let ExitGuide Help. Depreciation is handled differently for accounting.

Web Straight-Line Depreciation Formula. Depreciation is a way to reduce an asset value over a longer period of. Web Depreciation rate finder and calculator.

You can use this tool to. All-In-One System For Fixed Asset Depreciation Accounting Management And Reporting. The depreciation of an asset is spread evenly across the.

Web Use our free online depreciation calculator to work out the depreciation of the fixed assets for your business. Ad Discover how Bloomberg Tax Streamlines Fixed and Leased Tax Management. Available as an add-on solution for the Professional edition of Intuit ProSeries Tax or as stand-alone software.

First one can choose the straight. Web Straight Line Asset Depreciation Calculator. Example - Straight-Line Depreciation.

Web Depreciation limits on business vehicles. Web This depreciation calculator is for calculating the depreciation schedule of an asset. Web To set up Additional Depreciation.

It provides a couple different methods of depreciation. Web The four most widely used depreciation formulaes are as listed below. Web The basic formula for calculating your annual depreciation costs using the straight-line method is.

Web Before you use this tool. Straight Line Depreciation Method. Web You must take the deduction in the year you start using the asset.

Software Trusted by Worlds Most Respected Companies. Find the depreciation rate for a business asset. Example - Straight-Line Depreciation.

Calculate depreciation for a business asset using either the. Choose the icon enter Fixed Assets and then. Depreciation asset cost salvage value useful life of asset.

Asset Cost Salvage Value Useful Life Depreciation Per Year. To calculate straight-line depreciation. Web The basic way to calculate depreciation is to take the cost of the asset minus any salvage value over its useful life.

Web Depreciation Amount. If you choose to depreciate the printing press monthly you would need to simply do the same calculation based on the number of. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your.

Depreciation Formula Calculate Depreciation Expense

Free Depreciation Calculator Online 2 Free Calculations

How To Prepare Depreciation Schedule In Excel Youtube

Straight Line Depreciation Calculator Double Entry Bookkeeping

Depreciation Calculator

Create A Depreciation Schedule In Google Sheets Straight Line Depreciation Youtube

Depreciation What Is The Depreciation Expense

Free Macrs Depreciation Calculator For Excel

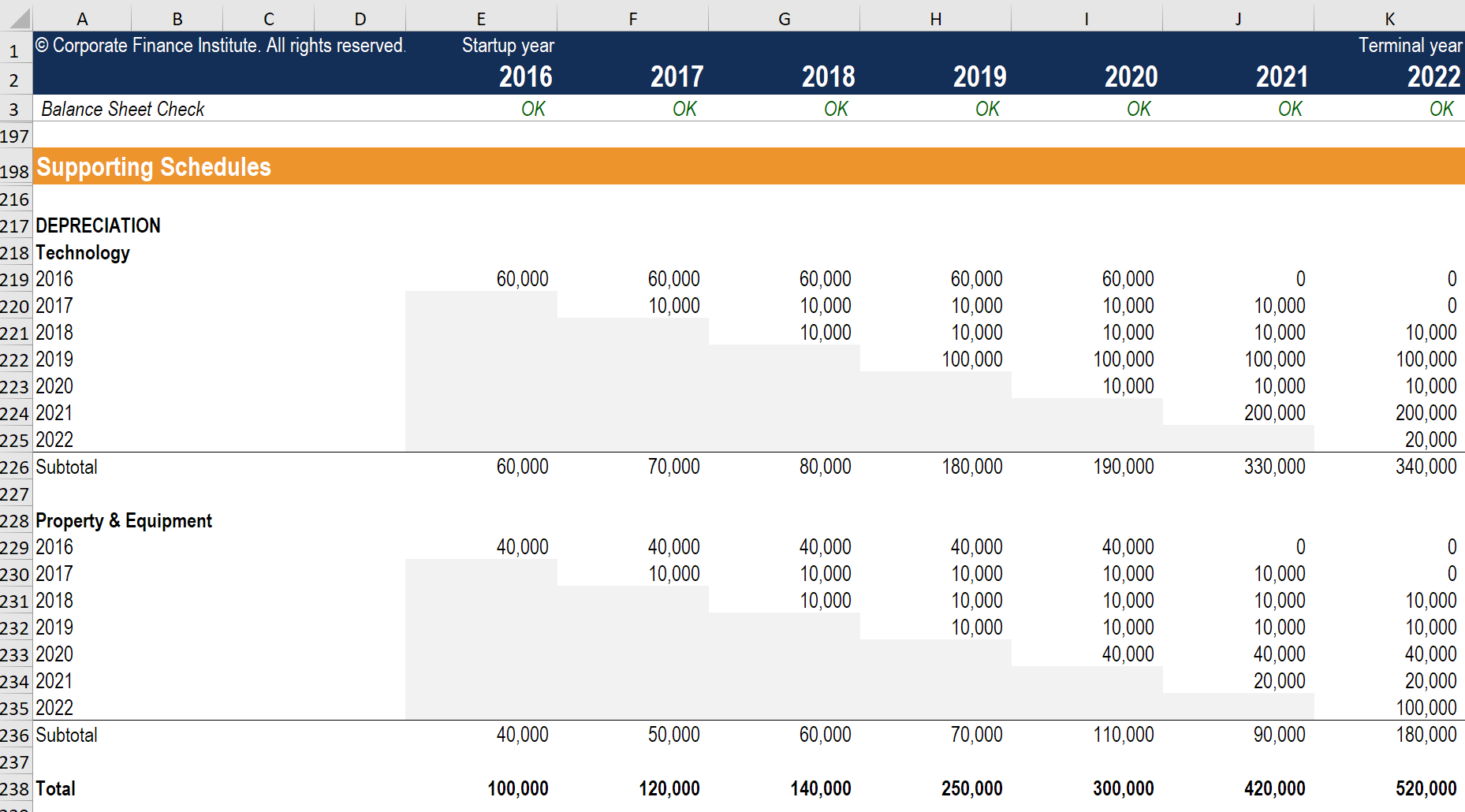

Depreciation Schedule Guide Example Of How To Create A Schedule

Download Depreciation Calculator Excel Template Exceldatapro

Asset Depreciation Schedule Calculator Template

Depreciation Schedule Template For Straight Line And Declining Balance

View Monthly Detail For Fixed Asset Depreciation Calculation Depreciation Guru

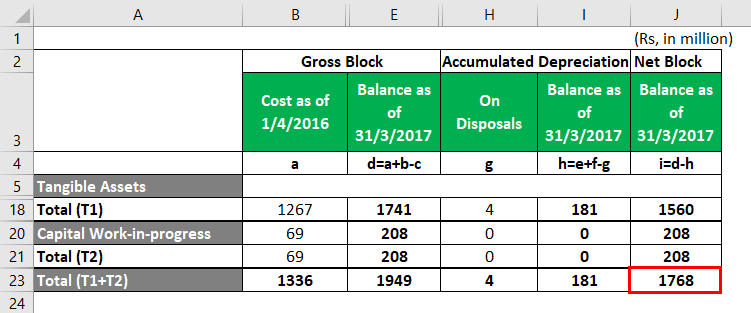

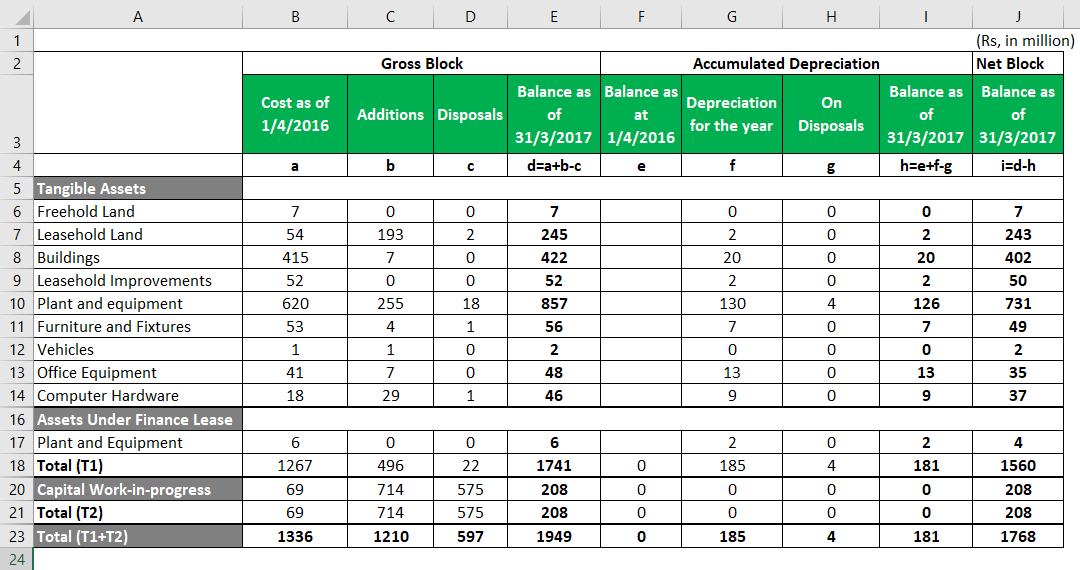

Accumulated Depreciation Formula Calculator With Excel Template

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Formula Calculate Depreciation Expense

Declining Balance Depreciation Schedule Calculator Double Entry Bookkeeping